Pension Increase Exchange (the PIE option)

Some members of the Sainsbury’s Pension Scheme who have not yet taken their pension have the option, at retirement, to give up some future pension increases in return for a one-off increase to their pension. This is known as Pension Increase Exchange (PIE).

Not everyone is eligible to take the PIE option, so check your retirement pack to see if it's listed as an option for you.

How it works

You can watch a short video about PIE here that provides an overview of how it works.

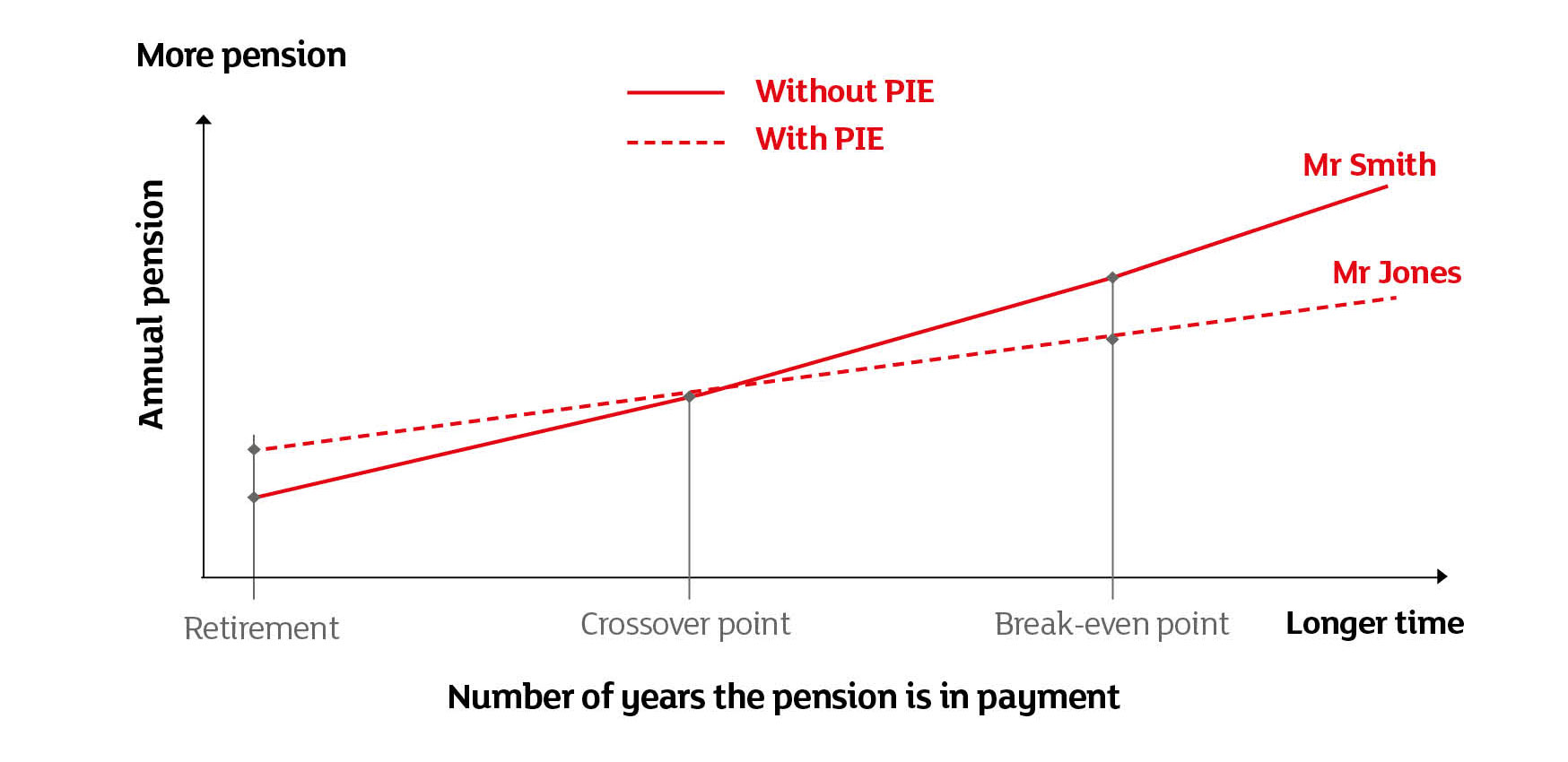

If you choose the PIE option, your pension would be higher at the beginning of your retirement but, because the increases would be lower, it might eventually end up being lower than what you would have got had you not chosen PIE. This is explained in the graph below, which compares two members with identical pensions.

Mr Jones takes the Pension Increase Exchange option. He gives up future increases on his pre-1997 pension and receives more money immediately after retiring than Mr Smith. As time passes, they reach the crossover point. They now receive the same amount of pension per year, as Mr Smith did not take the Pension Increase Exchange option, but he has been receiving increases to his pre-1997 pension. Eventually we reach the break-even point, when both members have received the same amount of money in total pension payments since they retired.

What else do I need to know?

If you choose the PIE option, you can still take up to 25% of your pension as tax-free cash (capped at £268,275). Your spouse or civil partner will still get a pension from the Scheme but part of their pension won’t receive increases.

In our Scheme, you’re only allowed to give up increases on the pension you built up before April 1997. That means any pension built up between April 1997 and when you retire will still get increases.

Where can I find out more?

We have built an easy-to-use modelling tool that lets you see how the PIE option could affect your retirement option. Click here to use the tool.

How do I know if the PIE option is right for me?

Neither Sainsbury’s nor the Trustee or Scheme administrator can provide you with advice on the PIE option. However, the Trustee is currently providing paid-for advice through LV= to those members who are considering taking the PIE option.

The specialists at LV= can answer any questions you may have and help you make an informed decision on whether the PIE option is right for you, based on your personal circumstances (including current income, tax position, state of health and family situation).